[RTS] Towards more transparent sale of assets in enforcement proceedings using eAuction

During the last year, there were almost 2,800 apartments, houses, and fields and 11,000 movables at the eAuction, which were taken over due to the lack of ability to repay debt. In the first round, the starting price is 70% of the estimated value, while in the second it goes down to 50%, NALED's research showed.

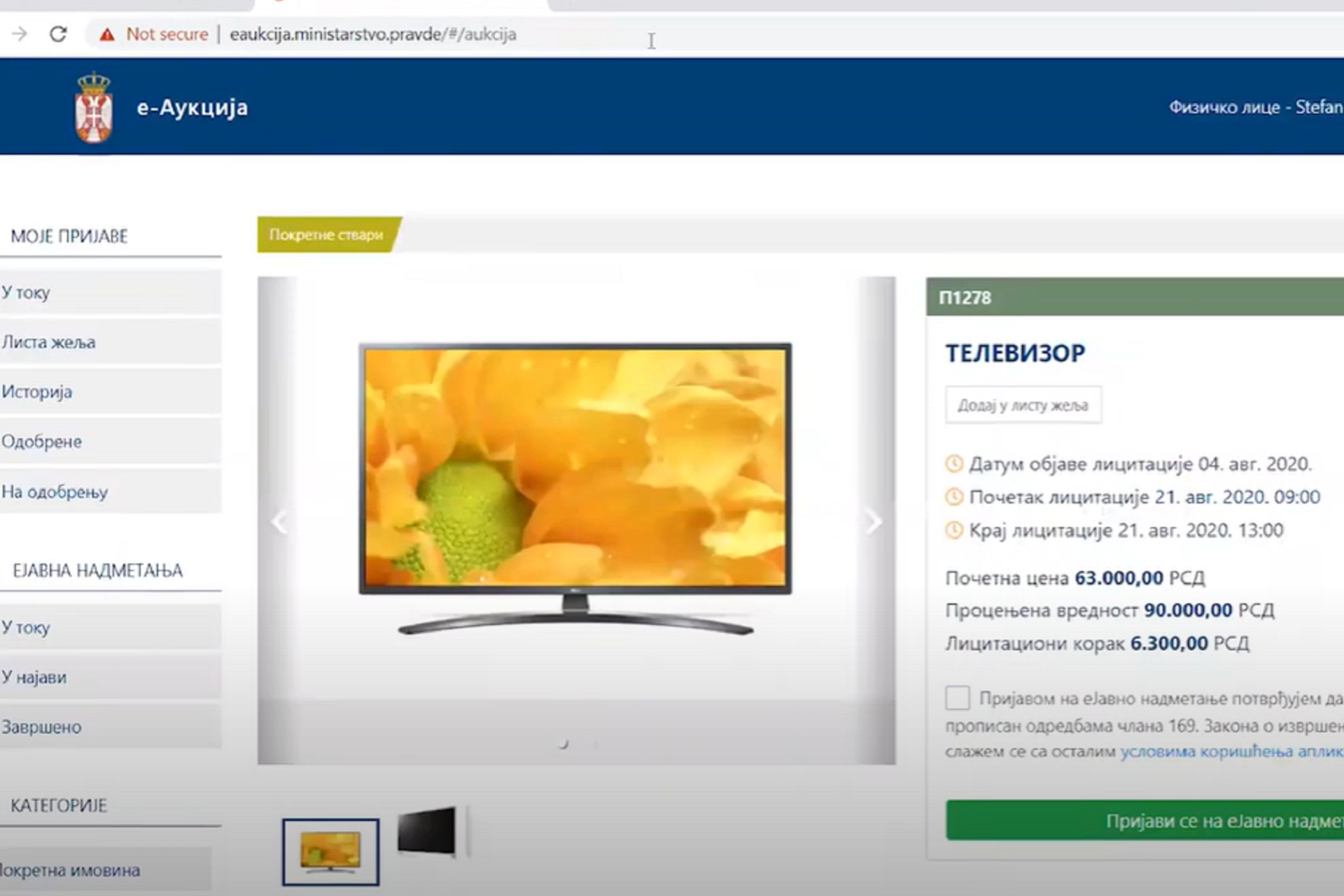

The electronic platform for auctioning items taken over in the enforcement procedure was introduced in 2020 following the Initiative of NALED's Alliance for Property and Investment, which placed Serbia in the group of 11 European countries that can boast of this electronic solution.

- The auction is something that we, at NALED, the professional public, and associations that deal with the protection of debtors, are extremely proud of. This platform is nothing but a transparent, efficient, and simplified procedure that leads to the best possible prices in electronic public tenders, something that is in the interest of every debtor. Debt is often less than the value of the property being sold, so this way the debtor is left with more when the real estate or movable property is sold for a better price - said Dejan Vukovic, vice president of NALED's Association for Property and Investment in the morning program of RTS.

When it comes to amount and quantity, debts were mostly to banks, but according to the number of debtors, most dents are owed to public utility companies, and cable and internet operators.

Although the percentage of citizens who do not repay loans on time increased from 2.3% to 2.5% compared to last year, Vukovic claims that this is a slight statistical growth, an insignificant indicator of indebtedness. As he explained, the trend we have had in the last few years since the National Bank of Serbia implemented the measures is such that we have reached the level of indebtedness of the countries of the European Union.

On the other hand, banks are very careful about the steps they take and their statutes of limitations are longer. According to Vukovic, they do not resort to coercion right at the beginning, but rather try to enforce the so-called peaceful payment - through call centers, SMS messages, and other communication channels, by timely reminding their debtors to settle their debts. If there is no progress, specialized agencies are hired to reach an agreement on settlement and eventual resolution of the dispute.

-Although their policies on this issue differ, banks usually go for forced collection after the sixth month. When it comes to utility companies, cable, and internet operators, this period is shorter, because the statute of limitations is up to one year - Vukovic added.

When it comes to mortgages, banks are even more trying to exhaust all peaceful funds and restructure debts because, according to the vice president of NALED's Alliance for Property and Investment, they are not interested in conducting this type of procedure either. Activations of mortgages secured by bank loans usually begin between the ninth and fifteenth months.

In an interview with RTS, Vukovic also referred to the restrictions regarding the burden of salaries due to housing loans.

-You have several scales for the possibility of debt collection through salaries and their limits. For example, with the minimum wage, debt collection can go up to a quarter of the amount, with average wages it is up to a third, and with above-average wages, it can be up to a half. It used to be a variant of up to 60%, but it is no longer used- he pointed out.